Please refer to important disclosures at the end of this report

1

Incorporated in 1999 as a joint venture between Adani Group and the Wilmar

Group, Adani Wilmar Ltd (AWL)

is an FMCG food company offering most of the

essential kitchen commodities for Indian consumers, including edible oil, wheat

flour, rice, pulses, and sugar.

Company’s portfolio of products spans across 3

categories: (i) edible oil, (ii) package

d food and FMCG, and (iii) industry

essentials. They have presence across a wide array of sub-categories wit

hin each

of these 3 categories.

A significant majority of their sales pertain to branded

products accounting for approximately 73% of their edible o

il and food and

FMCG sales volume for the financial year 2021.

Positives: (a)

Diversified product portfolio with leading brands catering to most

daily essentials of an Indian kitchen (b) Strong brand

recall and broad customer

reach (c) AWL has strong manuf

acturing capacity with 22 manufacturing units in

India (d)

AWL has the largest distribution network among all branded edible oil

companies in India with 5,590 distributors.

Investment concerns: Volatility in raw material prices and increase in compet

ition

could impact the profitability of the company.

Outlook & Valuation: In terms of valuations, the post-

issue TTM P/E works out to

37.6x (at the upper end of the issue price band), which is reasonable

considering

AWL’s historical top-line & bottom-line CAGR of ~13% and ~39

% respectively

over FY19-21. Further, Adani Wilmar has strong brand recall, wide distri

bution,

better financial track record and healthy ROE

. Considering all the positive

factors, we believe this valuation is at reasonable levels.

Thus, we recommend a

subscribe rating on the issue.

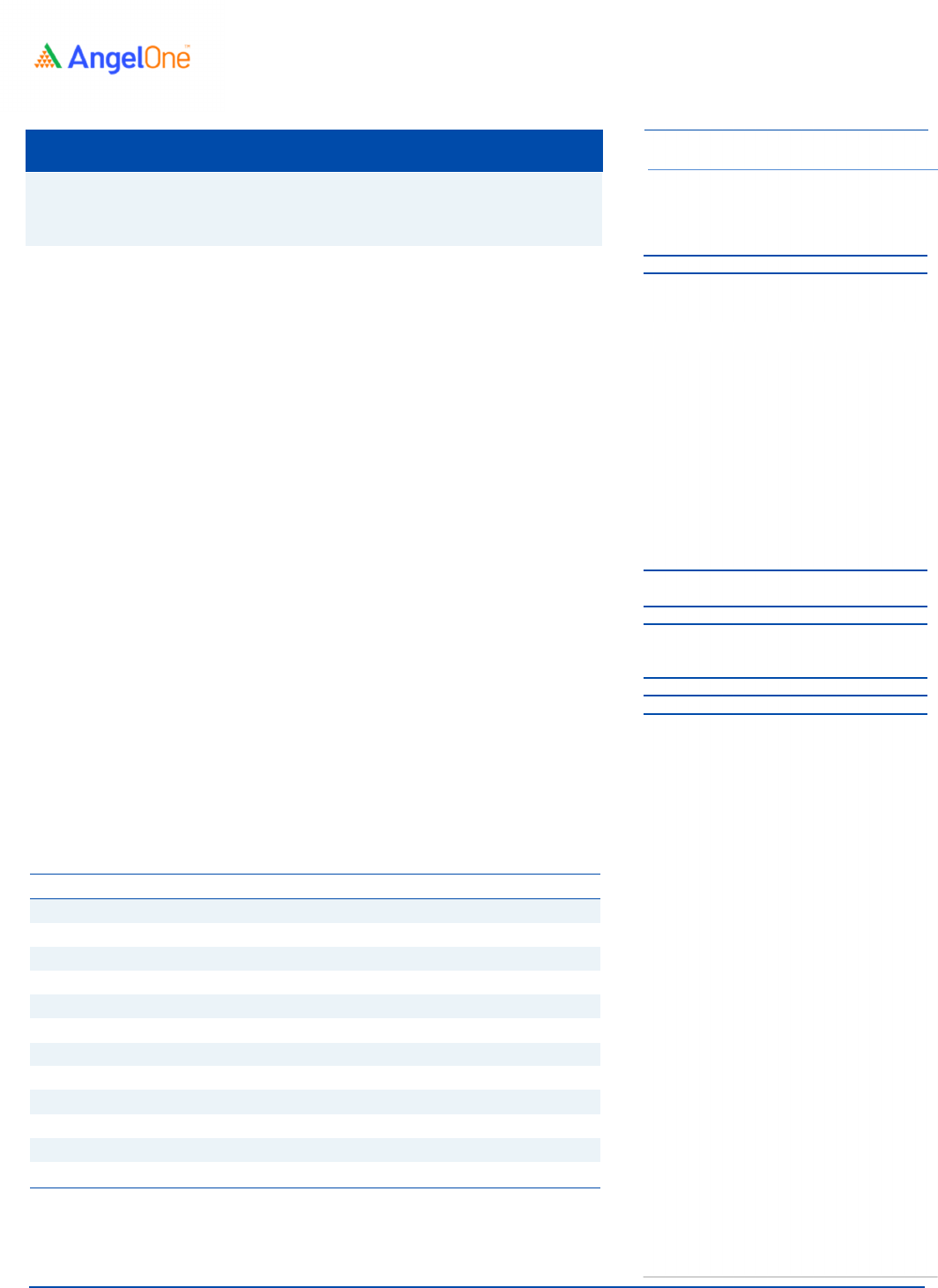

Key Financials

Y/E March (` cr) FY2019 FY2020 FY2021 1H

FY21

1HFY22

Net Sales

28,797

29,657

37,090

16,189

24,875

% chg

3.0

25.1

-

53.7

Net Profit

376 461 728

289

357

% chg

22.7

57.9

-

23.7

OPM (%)

3.9

4.4

3.6

4.1

3.2

EPS (`)

3.3

4.0

6.4

-

-

P/E (x)

70.0

57.0

36.1

-

P/BV (x)

12.5

10.2

8.0

-

RoE (%)

16.8

15.7

19.8

-

RoCE (%)

23.6

21.9

20.3

-

EV/Sales (x)

0.9

0.9

0.7

-

EV/EBITDA (x)

23.7

20.6

20.1

-

Angel Research; Note: Valuation ratios based on post-issue shares and at `230 per share.

Subscribe

Issue Open: Jan 27, 2022

Issue Close: Jan 31, 2022

QIBs 50%

Non-Institutional 15%

Retail 35%

Promoters 87.9%

Public 12.1%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `130.0cr

Issue size (amount): `3,600cr

Price Band: `218-230

Lot Size: 65 shares

Post-issue mkt.cap: `28,528*– 29,900cr**

Promoter holding Pre-Issue: 100.0%

Promoter holding Post-Issue: 87.9%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue:`3,600cr

Issue Details

Face Value: `1

Present Eq. Paid up Capital: `114.3cr

Jyoti Roy

jyoti.roy@angelbroking.com

+022 4000 3600, Extn: 6810

Adani Wilmar Ltd

IPO Note |

FMCG

January 24, 2022

Adani Wilmar Ltd| IPO Note

January 24, 2022

2

Company background

Incorporated in 1999 as a joint venture between Adani Group and the Wilmar

Group, Adani Wilmar is an FMCG food company offering most of the essential

kitchen commodities for Indian consumers, including edible oil, wheat flour,

rice, pulses, and sugar. The company also offers a diverse range of industry

essentials, including oleochemicals, castor oil and its derivatives, and de-oiled

cakes. The company's products are offered under a diverse range of brands

across a broad price spectrum and cater to different customer groups.

The company's product portfolio is categorized into (i) edible oil, (ii) packaged

food and FMCG, and (iii) industry essentials. "Fortune", the company's flagship

brand, is the largest selling edible oil brand in India. Recently the company has

focused on value-added products and has launched products such as edible oil

products, rice bran health oil, fortified foods, ready-to-cook soya chunks,

khichdi, etc in line with this.

The company operates 22 plants located across 10 states in India, comprising

10 crushing units and 19 refineries. The company's refinery in Mundra is one of

the largest single-location refineries in India with a capacity of 5,000 MT per

day. In addition to the 22 plants Adani Wilmar, also used 36 leased tolling units

as of Sep 31, 2021, for additional manufacturing capacities.

As of September 30, 2021, the company had 5,590 distributors in India located

in 28 states, and eight union territories, catering to over 1.6 million retail outlets

(Source: Technopak Report). Further, the company had 88 depots in India, with

an aggregate storage space of approx. 1.8 million square feet across the

country.

Issue details

AWL

is raising

₹

3,600

cr through fresh issue in the price band of

₹

218

-

230

.

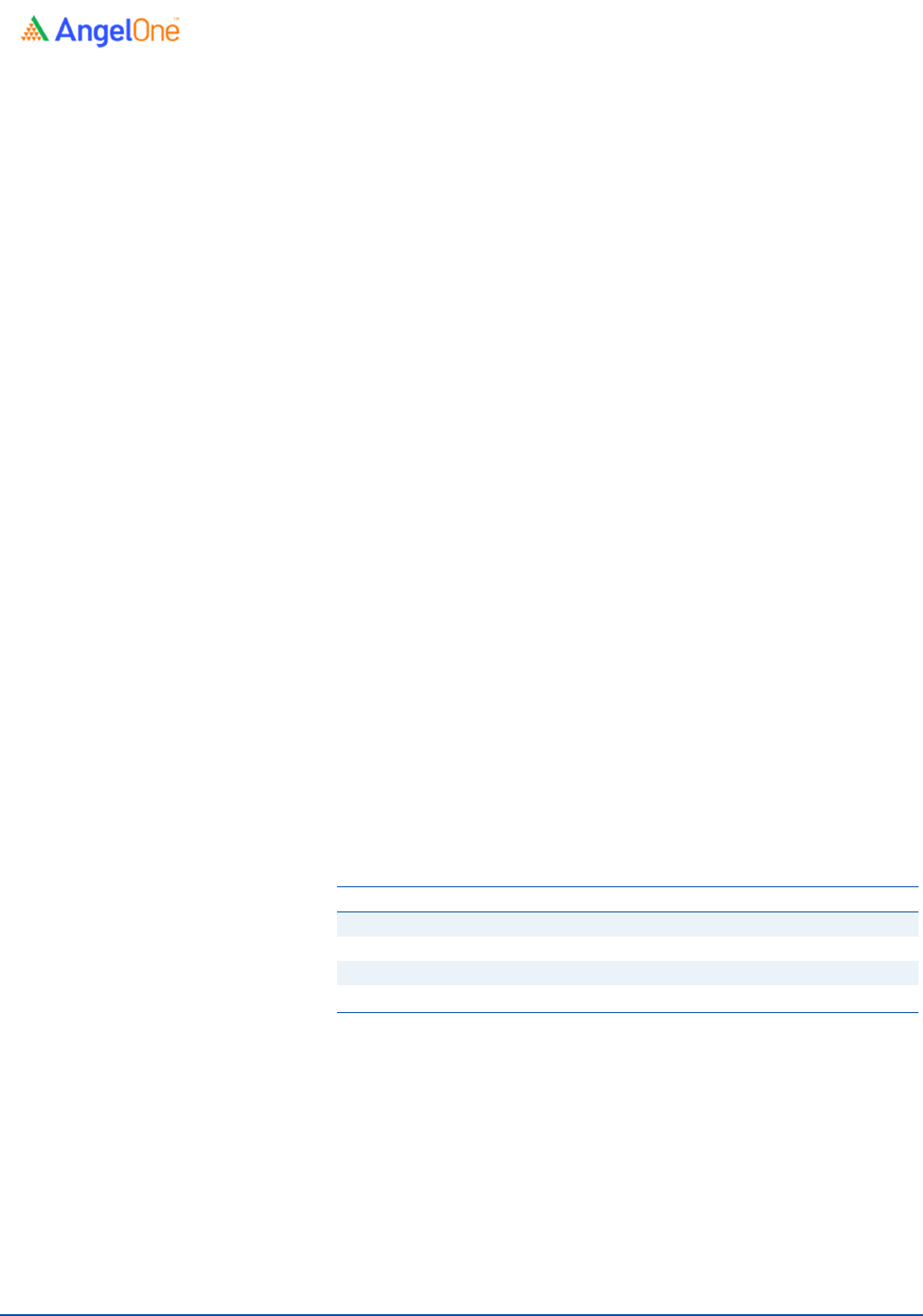

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue)

%

Promoter 1,142,948,860 100.00%

1,142,948,860

87.92%

Public NA

-

157,038,646

12.08%

Total 1,142,948,860

100.00%

1,299,987,506

100.00%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

Funding capital expenditure for expansion of existing manufacturing

facilities and developing new manufacturing facilities - ₹1,900cr

Repayment/prepayment of borrowings – ₹1058.9cr

Funding strategic acquisitions and investments -₹450cr; and

General corporate purposes.

Adani Wilmar Ltd| IPO Note

January 24, 2022

3

Exhibit 2: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020 FY2021

Net Sales

28,797

29

,657

37,090

% chg

3.0

25.1

Total Expenditure

27,666

28,348

35,765

Raw Material

24,119

24,451

31,518

Personnel

207

224

322

Others Expenses

3,340

3,672

3,925

EBITDA

1,131

1,310

1,325

% chg

15.8

1.2

(% of Net Sales)

3.9

4.4

3.6

Depreciation& Amortisation

199

241

267

EBIT

932

1,068

1,058

% chg

14.6

(1.0)

(% of Net Sales)

3.2

3.6

2.9

Interest & other Charges

487

569

407

Other Income

122

110

105

(% of PBT)

21.5

18.1

13.9

Recurring PBT

567

609

757

% chg

7.4

24.2

Tax

212

206

104

(% of PBT)

37.4

33.8

13.7

PAT before P/L Asso.Co.

355

403

653

Share in profit of Associates

21

58

75

PAT after P/L Asso.Co.

376

461

728

Basic EPS (Rs)

3.3

4.0

6.4

% chg

22.7

57.9

Source: Company, Angel Research

Adani Wilmar Ltd| IPO Note

January 24, 2022

4

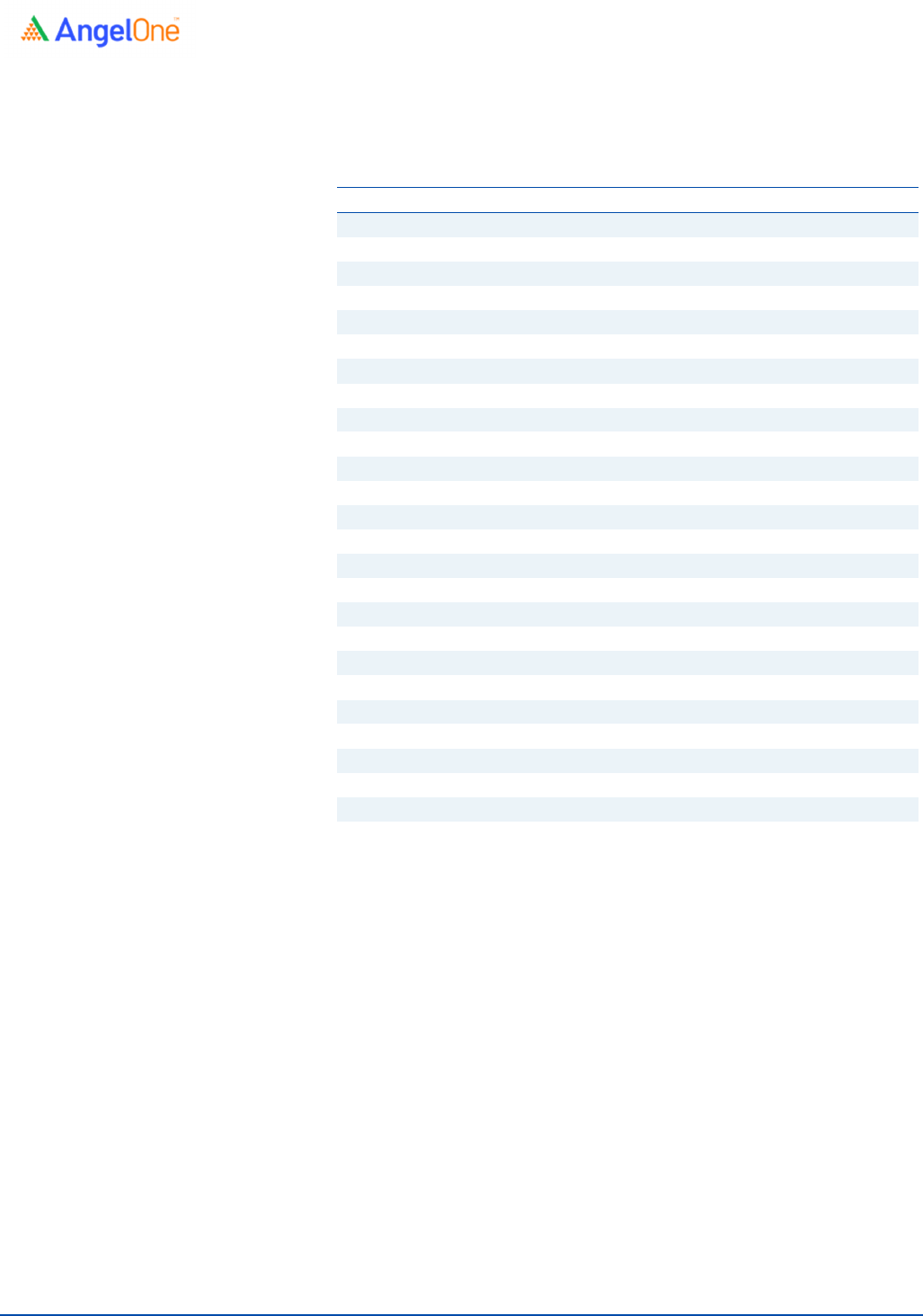

Consolidated Balance Sheet

Y/E March (` cr) FY2019 FY2020 FY2021

SOURCES OF FUNDS

Equity Share Capital

114

114

114

Reserves& Surplus

1,997

2,456

3,184

Shareholders Funds

2,111

2,571

3,298

Total Loans

1,829

2,300

1,904

Deferred Tax Liability

383

440

290

Total Liabilities

4,324

5,311

5,492

APPLICATION OF FUNDS

Net Block

3,027

3,758

3,701

Capital Work-in-Progress

570

325

531

Investments

147

206

332

Current Assets 7,85

8

7,497

8,763

Inventories

4,042

3,826

4,778

Sundry Debtors

1,258

921

1,515

Cash

1,215

1,432

1,188

Loans & Advances

1,116

1,152

1,150

Other Assets

227

166

132

Current liabilities

7,374

6,526

7,916

Net Current Assets

484

971

847

Deferred Tax Asset

95

51

81

Total Assets

4,324

5,311

5,492

Source: Company, Angel Research

Adani Wilmar Ltd| IPO Note

January 24, 2022

5

Exhibit 3: Consolidated Cash Flow Statement

Y/E March (` cr) FY2019 FY2020 FY2021

Profit before tax

567

609

757

Depreciation

199

241

267

Change in Working Capital

837

(495)

108

Interest / Dividend (Net)

262

338

260

Direct taxes paid

(134)

(121)

(294)

Others

(39)

209

(172)

Cash Flow from Operations

1693

781

926

(Inc.)/ Dec. in Fixed Assets

(908)

(631)

(462)

(Inc.)/ Dec. in Investments

(26)

124

(22)

Cash Flow from Investing

(934)

(506)

(484)

Issue of Equity

0

0

0

Inc./(Dec.) in loans

(424)

396

(395)

Dividend Paid (Incl. Tax)

0

0

0

Interest / Dividend (Net)

(338)

(404)

(336)

Cash Flow from Financing

(762)

(8)

(731)

Inc./(Dec.) in Cash

(3)

267

(289)

Opening Cash balances

82

79

346

Closing Cash balances

79

346

57

Source: Company, Angel Research

Adani Wilmar Ltd| IPO Note

January 24, 2022

6

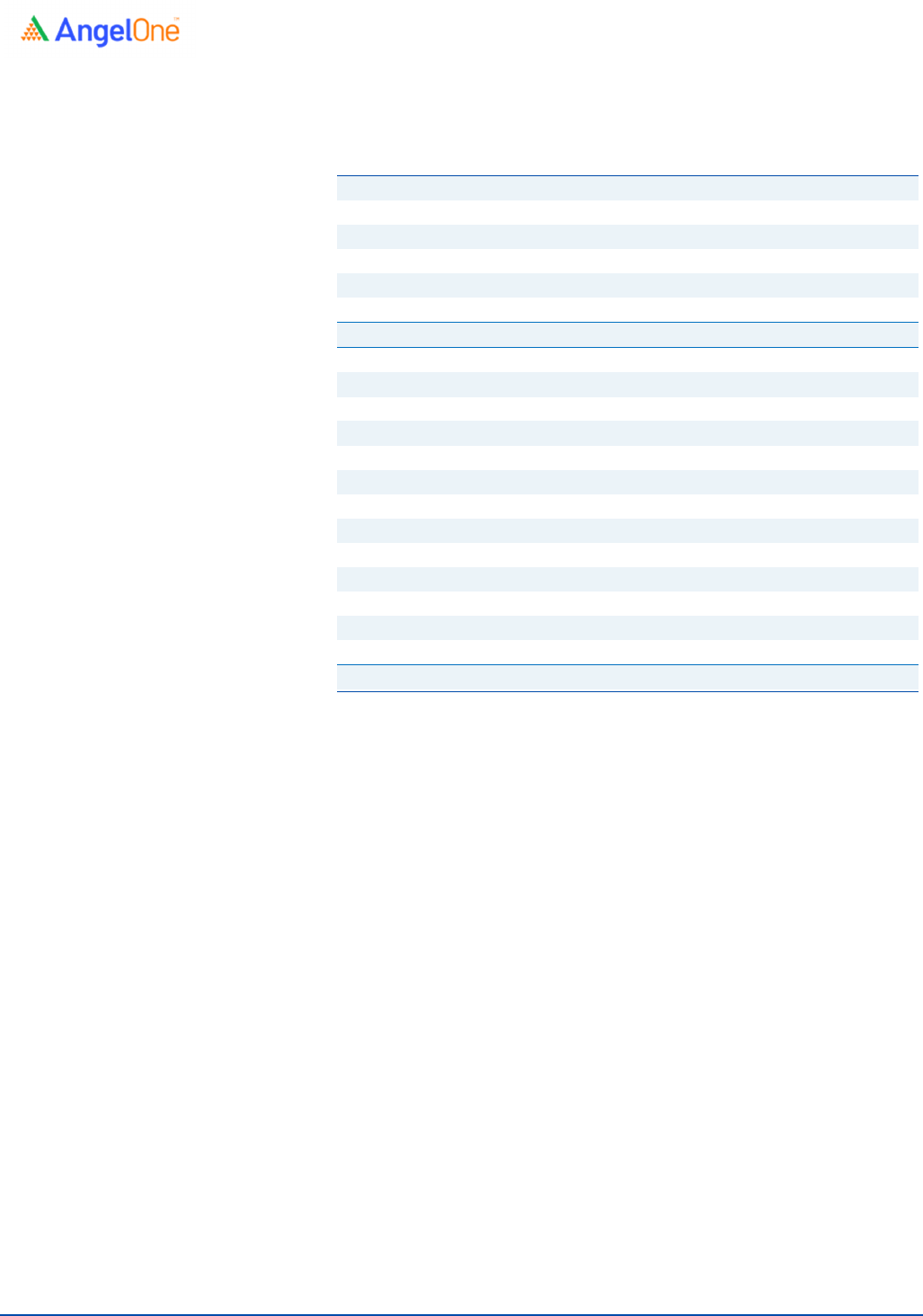

Key Ratios

Y/E March FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

70.0

57.0

36.1

P/CEPS

47.4

40.8

28.6

P/BV

12.5

10.2

8.0

EV/Sales

0.9

0.9

0.7

EV/EBITDA

23.7

20.6

20.1

EV / Total Assets

6.2

5.1

4.9

Per Share Data (`)

EPS (Basic)

3.3

4.0

6.4

EPS (fully diluted)

3.3

4.0

6.4

Cash EPS

4.8

5.6

8.0

Book Value

18.5

22.5

28.9

Returns (%)

ROCE

23.6

21.9

20.3

Angel ROIC (Pre-tax)

36.1

33.0

28.7

ROE

16.8

15.7

19.8

Turnover ratios (x)

Asset Turnover (Net Block)

9.5

7.9

10.0

Inventory / Sales (days)

51

47

47

Receivables (days)

16

11

15

Payables (days)

31

18

10

Working capital cycle (ex-cash) (days)

36

40

52

Source: Company, Angel Research

Adani Wilmar Ltd| IPO Note

January 24, 2022

7

Research Team Tel: 022 - 40003600 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking

or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel

or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection

with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.